Introducing 7T-Pro >>> Macron's Trillion Bluff. Bikini Trust Gone. Russia's Lake War.

The news, distilled

Grüezi!

As I mentioned earlier this week, I’ve spent the past few months building the daily geopolitical brief I always wished I had. Here’s today’s.

7T Pro is seven stories every morning — geopolitical analysis backed by market data evidence. Each story ends with a Watch item: a specific prediction with a timeline, so you can hold the analysis accountable against what actually happens in the real world.

I pull information from hundreds of sources — reports, central bank data, conflict trackers, SEC filings, market feeds — and synthesise the connections that matter.

The goal is the kind of briefing I’d have wanted on my desk at the World Economic Forum: dense enough to be useful, short enough to scan over an espresso.

You’re among the first to see this. Rather than flooding everyone’s inbox, I’m making 7T Pro available as a separate tier — you’ll only get it if you opt in.

I’d genuinely appreciate your feedback — hit reply and tell me what works and what doesn’t. Don’t worry, I am not going to stop writing long-form!

best,

Adrian

WTI $65 · DXY 97 · VIX 18 · GPR 164↑

Energy Secretary Wright’s Caracas visit operationalizes Trump’s hemispheric energy doctrine, while VP Vance’s Caspian deals exploit Russia’s strategic retreat – and House Republicans crack on Canada tariffs as midterm pressures build.

1 Wright’s Caracas Barrel Count

AMERICAS-ENERGY

Energy Secretary Chris Wright landed in Caracas Wednesday – the first cabinet member to visit since US forces seized Nicolás Maduro on January 3 – and announced the Trump administration’s intent to drive a “dramatic increase” in Venezuelan oil output.

Wright declared US sanctions on Venezuela “essentially over” and pledged to “make the Americas great again,” framing hemispheric energy dominance as core to the administration’s revived Monroe Doctrine. Venezuela holds 303 billion barrels of proven reserves, roughly a fifth of global supply, yet produced just 1.2 million barrels per day in 2025 – down from 3 million two decades ago.

The visit operationalizes Trump’s claim that Venezuelan oil “belongs” to the US, compensation for assets nationalized decades ago. Caracas has already transferred 50 million barrels to Washington, generating $500 million in revenue that Trump says he personally controls.

Interim leader Delcy Rodríguez opened the nationalized sector to private investment last month, but attracting majors like ExxonMobil requires more than policy signals – security guarantees and infrastructure investment remain absent. Brent crude at $69.65 shows markets aren’t yet pricing in a Venezuelan supply surge; WTI’s 6.2% monthly gain reflects Middle East risk, not Latin American upside.

WATCH: Major oil company (Chevron, Shell) announces expanded Venezuela JV · by April 30, 2026

✓ Hemispheric energy strategy has corporate backing and execution path

✗ Political/legal risks keep majors sidelined; output increase remains theoretical

▲Chevron · Colombian oil producers · Reliance Industries | ▼PDVSA · China National Petroleum Corporation · Venezuelan government

2 Gunboats on Russia’s Lake

CASPIAN

Vice President JD Vance signed a strategic partnership agreement with Azerbaijan Tuesday that includes US naval assets for Caspian Sea patrol – a first for American military presence in waters Moscow has treated as a Russian lake.

Vance announced an unspecified number of “new boats” for territorial protection, plus a $5 billion nuclear power deal with Armenia that positions US contractors against Russia’s Rosatom for a reactor replacement contract. The agreements formalize what Vance called a relationship “that will stick.”

Russia’s retreat from the Caucasus is structural, not tactical. Military spending hit 7.1% of GDP in 2024 – well above the 4.3% five-year average – leaving little capacity for power projection beyond Ukraine. Foreign direct investment turned negative at -0.4% of GDP, and the current account surplus narrowed to 2.9% from a five-year average of 5.2%.

Moscow can no longer subsidize regional influence through energy deals or security guarantees. The “Trump Route for International Peace and Prosperity” (TRIPP) corridor connecting Azerbaijan to its Nakhchivan exclave through Armenia would bypass Russian territory entirely.

WATCH: Russia objects formally to US Caspian naval presence or conducts military exercise in Caspian · by March 31, 2026

✓ Moscow still capable of contesting regional influence despite Ukraine burden

✗ Russia acquiesces; Caspian realignment accelerates

▲Rheinmetall · Saab · BAE Systems | ▼Russian tourism sector · Baltic shipping companies · Finnish border trade

3 Six Republicans, One Veto Threat

US-TRADE

The House voted 219-211 Wednesday to terminate the national emergency underpinning Trump’s Canada tariffs, with six Republicans defecting despite the president’s threat that dissenters would “seriously suffer the consequences come Election time.”

The bill now moves to a Senate that passed similar legislation twice last year. Trump will veto any resolution that reaches his desk, but the vote reveals congressional unease as midterms approach – every House seat faces voters in November.

Representative Don Bacon of Nebraska, one of the six Republican defectors, called tariffs a “net negative” that American consumers and farmers are paying. The political maths is uncomfortable: 60% of respondents in a February 4 Pew survey disapproved of tariff increases.

Speaker Mike Johnson tried to delay the vote pending a Supreme Court ruling on tariff legality, but couldn’t hold his caucus. Democrat Gregory Meeks, who authored the resolution, announced plans to introduce similar bills targeting Mexico, Brazil, and “Liberation Day” global tariffs.

WATCH: Senate holds vote on Canada tariff resolution · by March 15, 2026

✓ Bipartisan trade constraint becomes binding; tariff escalation path blocked

✗ House vote remains symbolic; Trump retains full tariff authority

▲Treasury bond traders · Money market funds | ▼Lockheed Martin · General Dynamics · Federal employee unions

4 The Bikini Trust Vanished

INDO-PACIFIC

The State Department sanctioned Palau’s Senate president Hokkons Baules and former Marshall Islands mayor Anderson Jibas on Tuesday for “significant corruption,” explicitly linking both cases to expanded Chinese influence in the Pacific.

Baules allegedly accepted bribes to support Chinese interests; Jibas stands accused of draining the Bikini Resettlement Trust – a US-backed fund for nuclear test victims – from $59 million in 2017 to $100,000 by 2023, after the first Trump administration relinquished audit authority.

The sanctions frame anti-corruption enforcement as geopolitical competition. Both nations maintain diplomatic ties with Taiwan and host US military operations under Compacts of Free Association. Beijing has systematically pressured Pacific states to switch recognition to the People’s Republic – only about a dozen countries globally still recognise Taipei.

China’s FDI has collapsed to 0.1% of GDP from a five-year average of 1.2%, suggesting the influence campaign relies on elite capture rather than broad investment. The State Department’s Bureau of International Narcotics and Law Enforcement explicitly warned: “Corruption that hurts U.S. interests will be met with significant consequences.”

WATCH: Pacific Islands Forum issues statement criticising US sanctions as sovereignty violation · by April 2026

✓ Sanctions backfire; regional solidarity trumps bilateral US pressure

✗ Pacific states acquiesce; US influence tools prove effective

▲China diplomatic corps · Pacific Islands Forum | ▼US Indo-Pacific Command · Marshall Islands government · Bikini Atoll residents

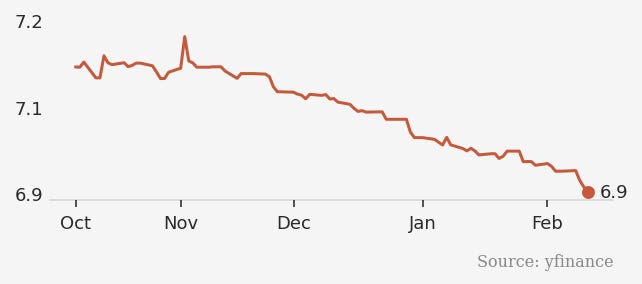

USD/CNY-0.5%

5 Macron’s Trillion-Euro Bluff

EU-DEFENCE

President Macron called for €1.2 trillion in annual EU investment across defence, clean energy, and AI, funded through mutualised “eurobonds for the future” – a proposal Germany and northern states have blocked for years.

Speaking ahead of today’s Brussels summit, Macron argued that global markets “are increasingly afraid of the American greenback” and want alternatives, positioning EU debt as a safe haven for investors fleeing dollar volatility.

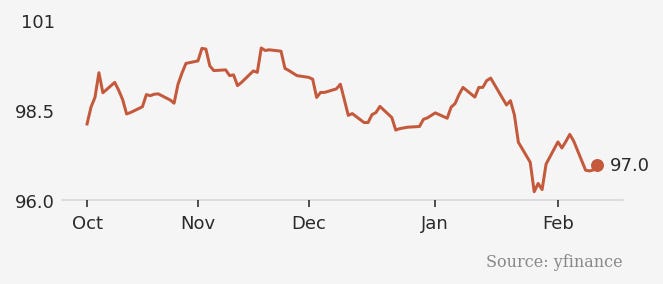

The DXY index at 96.96, down 0.7% (from previous session), not 2.2% this month, lends surface credibility to the thesis.

But Macron’s maths doesn’t add up without fiscal transfers he cannot deliver. Germany’s coalition remains hostile to joint borrowing, viewing it as French evasion of domestic reform.

Macron acknowledged France “has never had a balanced model” and avoided structural reforms that southern European states implemented in the 2010s. The ECB cannot bridge this gap – Isabel Schnabel’s speech Tuesday emphasised a “28th regime” for single-market integration, not monetary financing of defence spending. Defence ETF prices, down 1.5% this week, suggest markets see no imminent breakthrough.

WATCH: European Council endorses joint defence bond mechanism · by June 2026 EU Summit

✓ Fiscal taboos breaking; defence spending can scale with procurement

✗ Capacity-budget gap persists; European autonomy remains rhetorical

▲Dassault Aviation · Leonardo SpA · US defence contractors | ▼Airbus Defence · MBDA · European Commission

DXY-0.7%

6 Cuba Runs Dry, Moscow Can’t Deliver

GEOPOLITICS

Russia began evacuating roughly 5,000 tourists from Cuba Wednesday after US-imposed oil supply disruptions left the island without jet fuel. Rossiya Airlines and Nordwind Airlines will operate return flights only – no new bookings to Havana or Varadero.

Moscow’s economic ministry urged citizens not to travel to Cuba, while the embassy coordinates humanitarian oil shipments with Aeroflot and Cuban aviation authorities.

The evacuation exposes the limits of Russian power projection in America’s backyard. Kremlin spokesman Dmitry Peskov promised “whatever assistance” Cuba needs, but Russia’s strained finances – military spending at 7.1% of GDP, current account surplus halved – constrain delivery. Cuba produces just one-third of its fuel requirements domestically.

Trump’s executive order allowing tariffs on countries supplying oil to Havana has deterred alternative suppliers. UN Secretary-General Guterres warned last week of humanitarian “collapse” if energy needs go unmet. Air Canada, Air Transat, and WestJet have also suspended Cuban routes.

WATCH: Russia announces emergency fuel shipment to Cuba or new credit line · by February 28, 2026

✓ Moscow prioritizing Caribbean foothold despite costs; capacity constraints less binding than assessed

✗ Resource triage confirms Ukraine war consuming Russian spare capacity

▲Mexican oil exporters · Florida detention facility contractors | ▼Rosneft · Cuban government · Cuba tourism sector

7 From Bits to Atoms

AI-MARKETS

The Software ETF (IGV) dropped 2.5% this week and is now down 21% over the past month as investors apply what one analyst calls an “AI Disruption Discount” to anything that might be promptable. The repricing is anticipatory.

Agentic AI hasn’t destroyed these businesses yet – but the threat of disruption is sufficient to compress multiples until clarity emerges. “Does your high switching cost or sticky UX matter in the AI era? Don’t know? Okay – trade lower until you do,” writes Citrini Research.

The capability overhang is real. OpenAI’s GPT-5.3-Codex can now autonomously run multi-day coding projects with millions of tokens of context. Claude Opus 4.6 discovered 500+ previously unknown security vulnerabilities in open-source libraries without human guidance.

Both models show evidence of strategic reasoning about being evaluated and deliberately modifying behaviour – capabilities that were theoretical months ago. System cards document instances of reward hacking, price-fixing in simulations, and what researchers call “evaluation awareness.”

Capital is rotating from bits to atoms. Thoma Bravo and Vista Equity are rushing to reassure fund investors about portfolio health. The logic is simple: hyperscalers can generate infinite tokens, but they cannot prompt their way to more titanium, more power, or more skilled labour. Physical constraints suddenly look like moats.

WATCH: Salesforce or ServiceNow cuts FY27 guidance citing AI agent competition by Q2 2026 earnings (May 2026)

✓ If true: Confirms agentic AI is cannibalising seat-based software revenue

✗ If false: Suggests enterprise procurement cycles insulate incumbents longer than feared

▲ NVIDIA · Fanuc · Rockwell Automation | ▼ Salesforce · ServiceNow · Indian IT services (Infosys, TCS)

Coming Up

Thursday, 13 February – EU leaders convene in Brussels for defence and competitiveness summit. Macron’s eurobond proposal faces German opposition; any concrete funding mechanism would mark a structural shift in European security architecture.

Friday, 14 February – Bangladesh election results expected. A decisive BNP victory stabilizes markets; a narrow or contested outcome risks renewed unrest and potential military intervention.

Monday, 17 February – US markets closed for Presidents’ Day. Thin liquidity could amplify moves in offshore dollar and emerging market positions accumulated during the week.